On the back of surging freight rates during the pandemic, global freight forwarders have enjoyed record per unit gross profit (GP) between 2020 and 2022. This rise in GP per ton (or per TEU in ocean freight) has even overcompensated for forwarders’ increased operational effort from dealing with capacity shortages, congestion, and more generally, the disappearance of many established networks. This also resulted in record EBIT conversion rates (i.e. the portion of GP that makes it down to the EBIT line – traditionally a proxy for operational efficiency) despite higher per shipment effort and cost in forwarding operations.

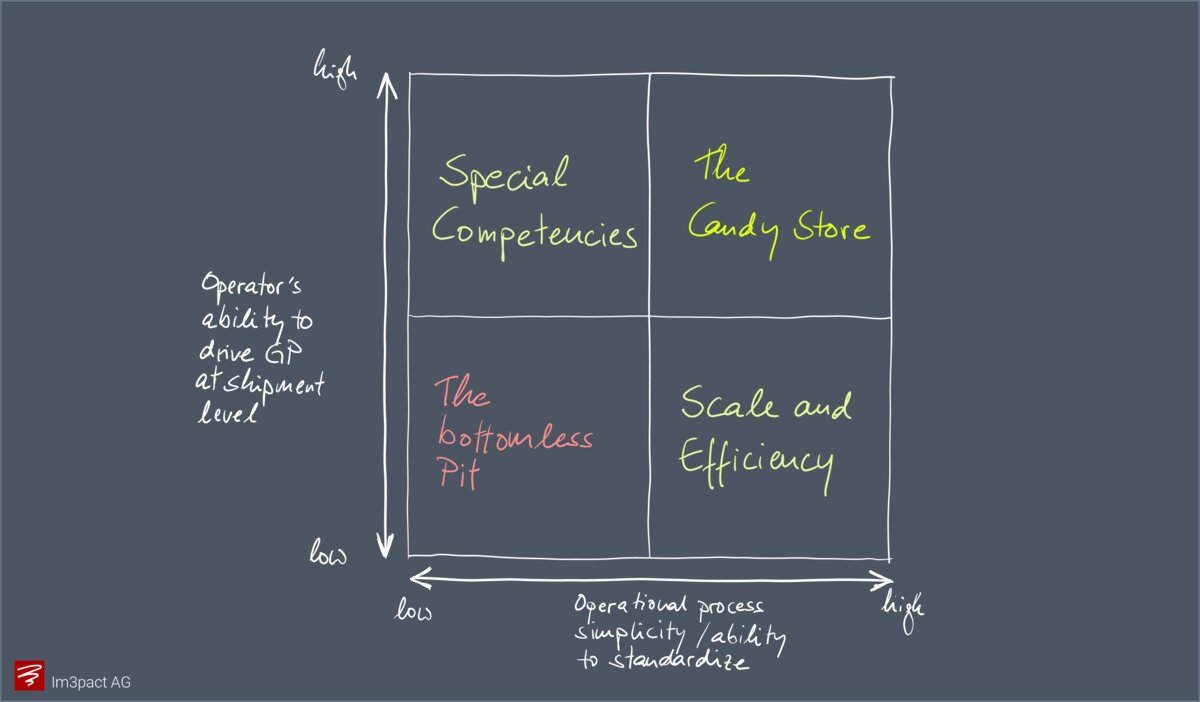

Now that GP per unit continues to drop, productivity in forwarding operations becomes key again for preserving the EBIT conversion rate. We found the framework sketched out in the image above a very useful lens through which to look at this productivity in order to make the right tradeoffs between GP and productivity for the sake of maximizing overall EBIT per unit.

In this framework, we segment the business handled by a forwarder along two axes: On the horizontal we differentiate by “process simplicity”, i.e. how easily the operational process for handling say a specific customer’s shipments can be standardized and to what extent it is free of cumbersome process complexities and variations. Shipments scoring high on this axis represent a highly repetitive and reasonably simple process, lending itself to centralization and automation. Scoring low means a high degree of process complexity and/or variation across shipments.

On the vertical axis, we differentiate to what extent the operator handling the shipments can influence GP per shipment through smart ad-hoc pricing, upselling, and smart buying decisions. “High” on this axis means the operator has room to maneuver and drive up GP per shipment while “low” means she cannot do much, because these shipments are governed by long-term contracts locking down all commercial decisions regarding service scope, pricing, and even carrier choice.

Across the resulting tableau we are looking at four basic types of shipments handled in forwarding operations:

-

Special Competencies on the top-left: These shipments are complex (and possibly irregular) and therefore expensive to handle. However, they also allow driving sufficient GP to (over-) compensate for this higher operational complexity. These could be time and temperature sensitive healthcare shipments or highly valuable and vulnerable cargo. Here it pays to invest into highly skilled operators who can reliably handle the special requirements while being empowered and incentivized to exploit GP opportunities.

-

Scale and Efficiency on the bottom-right: These shipments allow for high-throughput, repetitive processing while leaving no room to influence GP at shipment level. Consequently, we must maximize productivity to drive EBIT conversion through process optimization, economies of scale, and automation. Typically, this is “fully SOP’d” large customer business without unnecessary complexity, locked in under long-term contracts.

-

The Candy Store on the top-right: This is the sweet spot where complexity and price sensitivity are limited, allowing operators to create and exploit GP opportunities without loosing this incremental GP on the way to the bottom line through expensive processing requirements. SME business is often associated with this quadrant, backed by strong local customer relationships and insight.

-

The bottomless pit on the lower-left: This is the dreaded area with cumbersome operational processes but no wiggle room for driving incremental GP because all aspects of service and pricing are locked in contractually. This can be large global account business, pursued in a quest for tonnage but with painful consequences for operations. Here right-pricing with full awareness of the operational per unit cost is the only protection if one cannot avoid this corner.

Different forwarders may place their strategic focus on different areas of this tableau. Beyond a certain scale they will however have to accommodate a mix of the different shipment types. Providing different production channels can help to match GP with operational cost per shipment. Similarly, segmenting overall shipment volumes this way can also help to match the right talent with the right processing profile and requirements. That is perhaps a topic for another post in the future – stay tuned …